More than half of the fourth quarter of 2017, when car companies and battery companies are busy sprinting sales, an alarming news is spreading. In 2018, the subsidy policy for new energy vehicles will decline ahead of schedule and make greater adjustments. . The car companies and battery companies that experienced the adjustment of the subsidy policy in 2016 are like a frightened bird. How subsidies are adjusted, where companies go, and the traditional peak season of the new energy industry is overshadowed by gloom.

The Battery China Network has carefully sorted out the various versions of the current subsidy policies that are circulated on the Internet: from the middle or late October, it is reported that the 2018 will be retreat ahead of time in 2018, and the rate of slope reduction will be 20%; the rate of financial retreat will be circulated in early November. It will reach 40%; and then to the "outflow" of the Ministry of Finance on the contents of the subsidy policy review draft, the new energy vehicle subsidies will be carefully divided. All indications are that although the subsidy policy adjustment plan has not yet been implemented, the adjustment of subsidies in 2018 has been firmly established. (For more details, please refer to Battery China Network's article “Which is the most reliable solution for network subsidy retreat?â€)

Zhou Bo, director of the research division of the Power Battery Application Branch of the China Chemical and Physical Power Industry Association, believes that the adjustment of the subsidy policy will help improve the quality of new energy vehicle products, help the related resources to move closer to leading companies, and enable the industry to have a representative group of representatives. The enterprises, so that the normative improvement of the industry will help the new energy automotive industry bigger and stronger. However, it is undeniable that neither the technical parameters nor the financial subsidies will bring about a new round of “strong earthquakes†in the new energy auto industry in 2018.

From a macro perspective, in accordance with the national "long-term development plan for the automotive industry," requirements: by 2020, the annual sales of new energy vehicles will reach 2 million, and the specific energy of the power battery will reach 300 Wh/kg or more, and efforts will be made to achieve 350 Wh/kg. The specific energy of the system strives to reach 260Wh/kg and the cost drops below 1 yuan/Wh. By 2025, new energy vehicles will account for more than 20% of automobile production and sales, and the power battery system will have a specific energy of 350 Wh/kg. Based on this, the specific energy of the system will vary from the current 120Wh/kg to 260Wh/kg in 2020, a difference of 140Wh/kg. In the next three years, it is expected to increase by more than 40Wh/kg per year. In other words, the annual national energy density adjustment limit will be around 40Wh/kg.

From the perspective of financial subsidies, according to the budget of the Ministry of Finance that is set to subsidize 30 billion yuan each year, as the number of new energy vehicles increases, the corresponding unit vehicle subsidies will certainly be reduced. From the current news circulating on the Internet, the national subsidy standard has gradually become more meticulous. From the current details of the flow, it is quite targeted.

Detail 1: What does the system energy density increase by 20Wh/kg instead of 40Wh/kg?

As mentioned above, if we want to achieve the national "long-term development plan for the automotive industry" requirements, then the future system energy density adjustment of new energy vehicles will be 40Wh/kg. Based on this calculation, the energy density of the pure electric passenger car system must reach 160Wh/kg in 2018 to obtain the state's 1.1 times subsidy; and from the current Ministry of Finance's 2018 subsidies review draft, the government does not have the relevant technology. The parameters were adjusted for eagerness and instant benefit, but the upward adjustment of 20Wh/kg was achieved. The energy density of the new energy vehicle system reached 140Wh/kg, and the maximum subsidy of 1.1 times was obtained. For pure electric buses, the current subsidy policy in 2017 will only give a 1.2-fold subsidy for a pure electric bus with an energy density of 115 Wh/kg. According to projections of the 2018 adjustment limit, it will be 155 Wh/kg, which is currently considered by the Treasury’s 2018 subsidy. According to the manuscript, a pure electric bus with an energy density of 140 Wh/kg will receive a 1.2-fold subsidy.

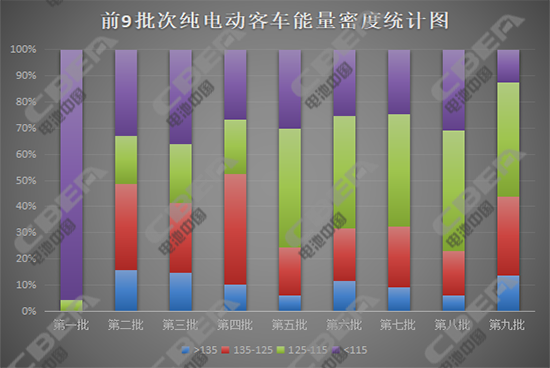

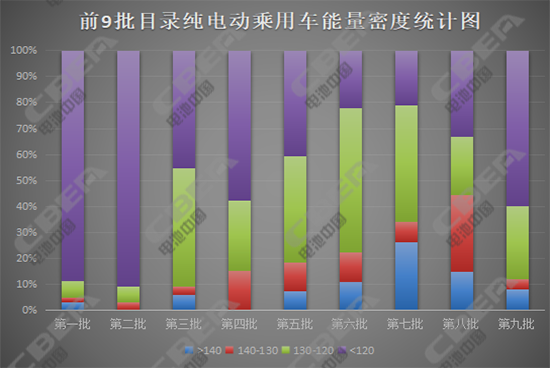

Citing the Report on the Status Quo and Future Trends of China's New Energy Automotive Power Battery Development in 2017 by the Research Institute of Power Battery Applications of the China Chemical and Physical Power Industry Association, the 1-9 batch of “New Energy Vehicle Promotion Catalog†pure electric buses ( (Fast charging) and analysis data of system energy density of pure electric passenger cars. See below:

(Data source: Research Division of Power Battery Application Branch of China Chemical and Physical Power Industry Association)

According to the Battery China Network, in terms of pure electric buses, the 1-9-batch New Energy Vehicle Promotion Catalogue has the highest energy density of the core system produced in the Ningde era, reaching 137.27Wh/kg; and in pure electric passenger vehicles, Lifan cars are equipped with a multi-composite lithium-ion battery pack that is powered by Miaosheng Power. The energy density of the system is 152.90Wh/kg. If the limit value is adjusted according to the requirements of the "Long-Term Development Plan for the Automotive Industry", the impact on car companies will be enormous.

The development of new products by auto enterprises requires going through the project-design-testing-verification-testing-announcement-listing. Such a long process means huge economic costs and time costs for car companies. With reference to fuel vehicles, it usually takes three to five years for car companies to develop a matured model. Once the model is marketed, it needs to reach the five-year sales cycle or sales target of 100,000 units to recover the previous research and development costs. . From the perspective of the market, with the changes in subsidies, some models that are difficult to obtain subsidies will be forced to withdraw from the market; on the other hand, changes in subsidies will lead to changes in the market status of some competing vehicle models, and the difference in subsidies will cause auto companies to re-adjust His own production plan led to the early exit of some huge R&D models from the market. If the energy density of the vehicle system is overestimated, it is highly likely that the car companies will be busy adjusting and there will be no car available for sale.

As far as the current domestic battery company's production level is concerned, the increase in system energy density by 20Wh/kg is a more consistent approach to the actual capacity of power battery companies. At present, the group efficiency of LiFePO4 batteries for pure electric buses is about 80%. In the future, according to the limit of group efficiency of 90%, the lithium iron phosphate batteries need to reach the limit energy density of 180Wh/kg to meet the system energy density of more than 155Wh. /kg subsidy limit; and in the pure electric passenger car, with a ternary material core package efficiency of 60% estimated, in order to meet the technical requirements of pure electric passenger car system energy density 160Wh/kg, then Monolithic cells have an energy density of at least 260 Wh/kg. (Group efficiency refers to the ratio of system energy density to monomer energy density. Affected by the shape of the battery, packaging technology, and PACK design, the group efficiency of the battery core will be different, and it is guaranteed under the premise of ensuring PACK-related safety and product usability. The higher the grouping efficiency, the better the utilization of the vehicle cells.)

According to the battery China Network, the current domestic battery companies have a capacity of up to 150Wh/kg in the lithium iron phosphate square core, and the highest capacity of 145Wh/kg in the lithium iron phosphate cylinder core, phosphoric acid. Lithium iron soft package companies claim to be able to do more than 175Wh/kg, but it is understood that there is no actual example of assembly on the car; Sanyuan soft package has the highest production capacity of 220Wh/kg, three yuan cylindrical battery with the highest With a mass production capacity of 240Wh/kg, the ternary prismatic battery has a production capacity of 200Wh/kg. The state adopts more moderate measures to increase the parameters of the energy density of the subsidy system, which is consistent with the current industry status and is more feasible.

Detail 2: The intention of controlling the national market for pure electric passenger cars

Although the subsidy retreat is a foregone conclusion, how the subsidy will be retired, when it will be retired, and how much it will be refunded will also be an important factor affecting the development of auto companies. Prior to this, the financial subsidies for cybernetics will directly reduce the slope by 40%. Today, judging from various signs, the possibility of a nationwide “one size fits all†is unlikely. Instead, it is highly likely that there will be targeted adjustments to subsidy policies.

In a certain sense, the 40% reduction is not shocking. Ouyang Minggao, executive vice president of the China Electric Vehicles Centennial Association and deputy director of the Academic Committee of Tsinghua University, once made the following judgment on China’s financial subsidy for the new energy auto industry. He believes that the government’s subsidy behavior is a demonstration of the government from 2010 to 2015. Financial subsidies are the “first driving forceâ€; and by 2014–2017 government subsidies and government purchases are the main drivers of new energy vehicle development; and from 2017 to 2020, new energy vehicles will transition from the market introduction period to maturity. The products are initially competitive in the market, and financial subsidies only play an auxiliary role in the development of the industry; and in 2019-2025, new energy vehicles will achieve greater development under the dual drive of the “double-credit†management approach and the market, with financial subsidies. Complete exit after completing the transitional guidance. In the transitional period of 2018, which is supported by the introduction of financial subsidies, combined with the development trend of the industry, it is highly likely that financial assistance will be given with some emphasis. As for the current trend of national policy control, it will focus on supporting long-haul mileage models, while vehicles with lower driving mileage may experience subsidized cliffs.

According to the network subsidy policy, in the case of pure electric passenger vehicles, the subsidy for 2018 will be based on the current driving range of new energy vehicles, and at the same time, the subsidy for the lowest-range vehicles will be reduced. 50%, to make up for 50% of cliff-style adjustment. For high-mileage mileage models, detailed adjustments are also made, and adjustments are relatively moderate. Theoretically, the development of high-continent mileage vehicles is encouraged.

Although the debate on the development path of China's new energy vehicles is not uniform, but from the current state to achieve "auto power", the attitude of overtaking the curve point of view, high mileage vehicles continue to be the focus of the future development of new energy vehicles. The current subsidy policy does not meet the national expectations. The most representative one is that the new energy auto market is tilting toward the “low-end marketâ€. The weak market demand for high-end new energy vehicles has caused car companies to adjust their production directions one after another, positioning the future production focus on small cars under 100,000 yuan. This situation is something that the country does not want to see.

The guiding policy is trying to find a balance between the market and the future development of new energy vehicles. At present, new energy vehicles are still in the popularization stage, and consumer acceptance of new energy vehicles is not high. The era of the buyer's market in China's auto market has come. In addition, new energy vehicles have not yet formed a competitive advantage with traditional fuel vehicles. It is also reasonable that the high-end pure electric vehicle market is cold.

The sub-subsidy price of a micro-mini pure electric vehicle with a price of less than 100,000 yuan is basically the same as the price of a fuel vehicle of the same grade. In the first-tier cities like Kitsuketsuto, the number plates are tense and traffic restrictions are numerous. Micro-mini electric vehicles have less investment and are favored by consumers. The subsidized prices of mid- to high-end new energy passenger vehicles are generally higher than those of similar fuel vehicles. , Relatively low cost performance, relatively small market demand. However, it is worth noting that at present, there are a large number of micro-mini pure electric vehicles manufacturing companies in China, which have mixed fisheries, and uneven quality of vehicles. This has also caused a great impact on the ecology of the new energy automotive industry.

The country’s implementation of cliff-type slope retreat for subsidies on small vehicles with low driving range will force companies to increase the production process of vehicles and reduce the production costs of vehicles; at the same time, it will stimulate competition among car companies and will allow some enterprises to withdraw early. It plays an important role in improving the overall ecology of the industry. Subsidies for new energy vehicles with high cruising range are also conducive to medium-to-high-end new energy passenger vehicles and micro-mini passenger cars in the price close. For power battery companies, the subsidy fall will directly affect the purchase prices of power batteries for car companies. Power battery companies will urgently need to reduce production costs. Looking at the profitability of upstream companies in the power battery industry this year, the gross profit margin of these companies is generally high, and in 2018, the overall cost reduction of the industry is bound to shift upstream. On the other hand, with the adjustment of the car enterprise ecosystem, the battery company's ecosystem will also face changes. Some low-end production capacity is in urgent need of conversion, and it is highly likely that a large number of production capacity will be forced to be eliminated.

Why is it that the subsidy for new energy buses and special vehicles on the Internet has dropped sharply? What does the net-traffic countries use as a reference indicator for energy consumption and energy consumption per unit of energy per hundred kilometers? How to change the new energy automobile market? Where will the battery company go? Listen to the next decomposition.

Aluminum Cookware,Die Casting Cookware,Investment Casting Cookware,Die Casting Aluminum Cookware

Ningbo Beilun Huari Metal Products Co., Ltd. , http://www.huari-metal.com